*Includes principal invested and appreciation of investments originated via the UpMarket platform based on historical trade volume and valuation estimates through December 31, 2025. Of the total, approximately $146 million is managed by UpMarket Management, with the remaining originated investments managed by affiliates. Past performance is not predictive of future results.

We Have Helped Our Clients Invest In*

Curated access to startup unicorns, hedge funds, and private equity—built for sophisticated investors.

Enjoy access that empowers you to invest where the world is headed, not where it is today.

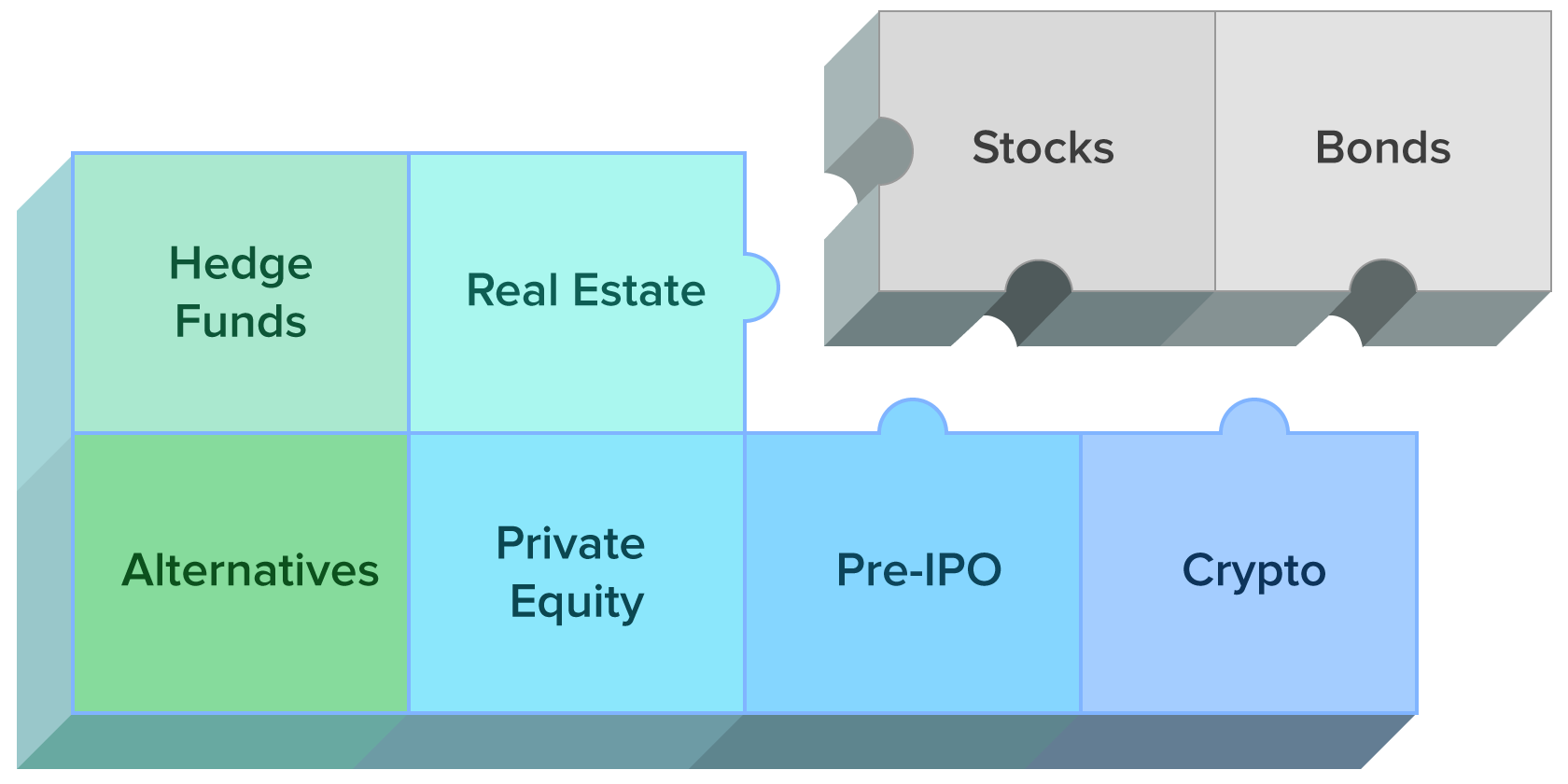

Go beyond traditional markets and build a more diversified portfolio.

*UpMarket is not affiliated with, endorsed by, or sponsored by any of the companies whose logos or names may appear on this site. All trademarks and registered trademarks are the property of their respective owners. Investments in shares of these companies are made available through transactions in the private secondary market and do not constitute any direct offering by the companies themselves, nor do they imply any partnership or other association with UpMarket. Past performance is not indicative of future results. Investments in private securities involve risk, including the potential loss of principal.

Why Individual Investors Choose UpMarket

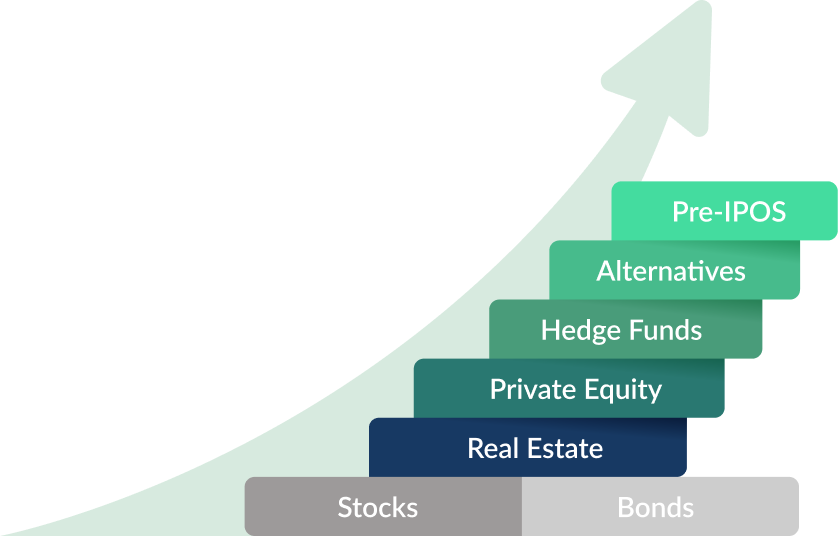

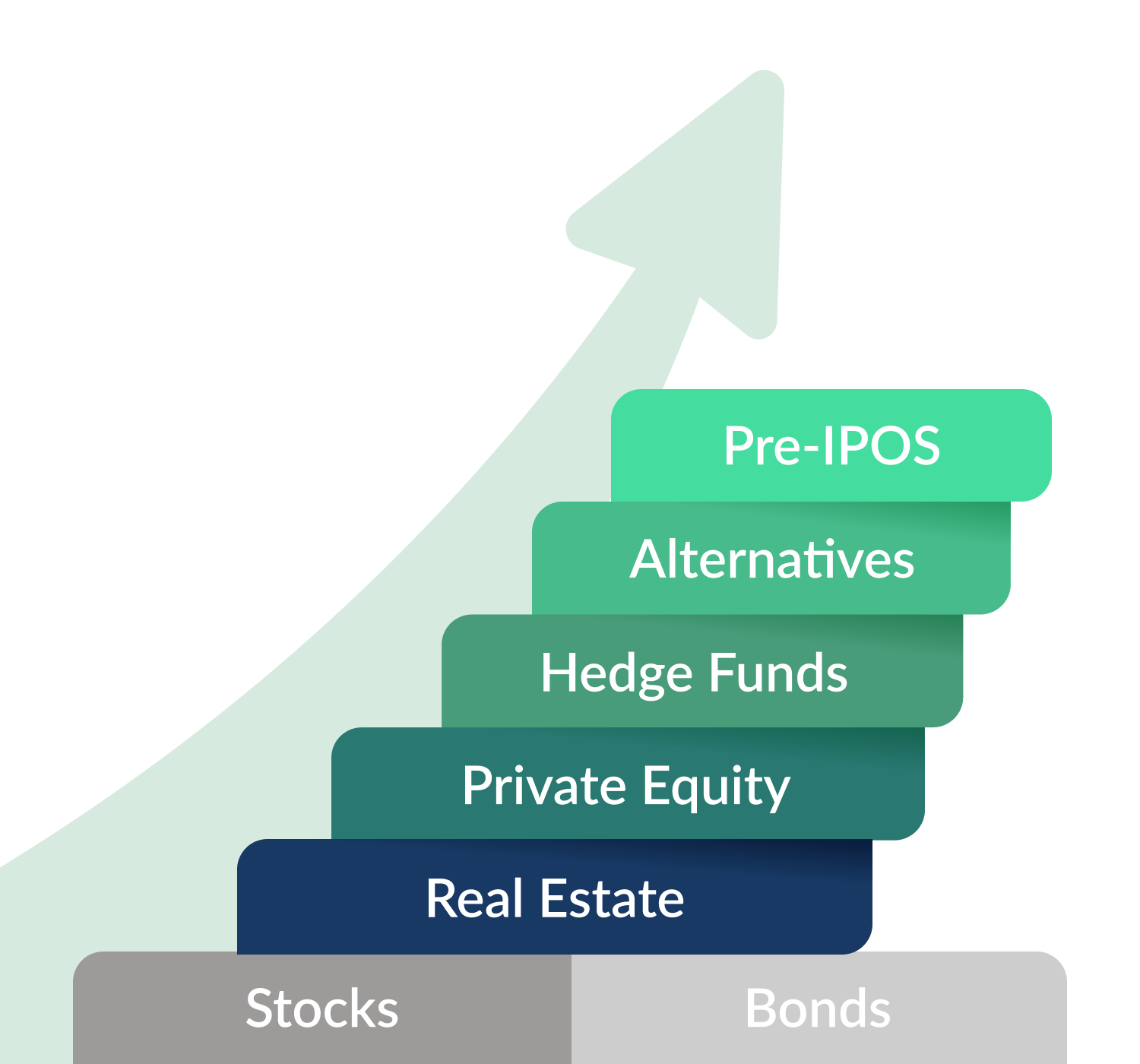

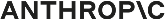

Alternative investments can increase portfolio diversification and deliver unique capital preservation or appreciation opportunities.

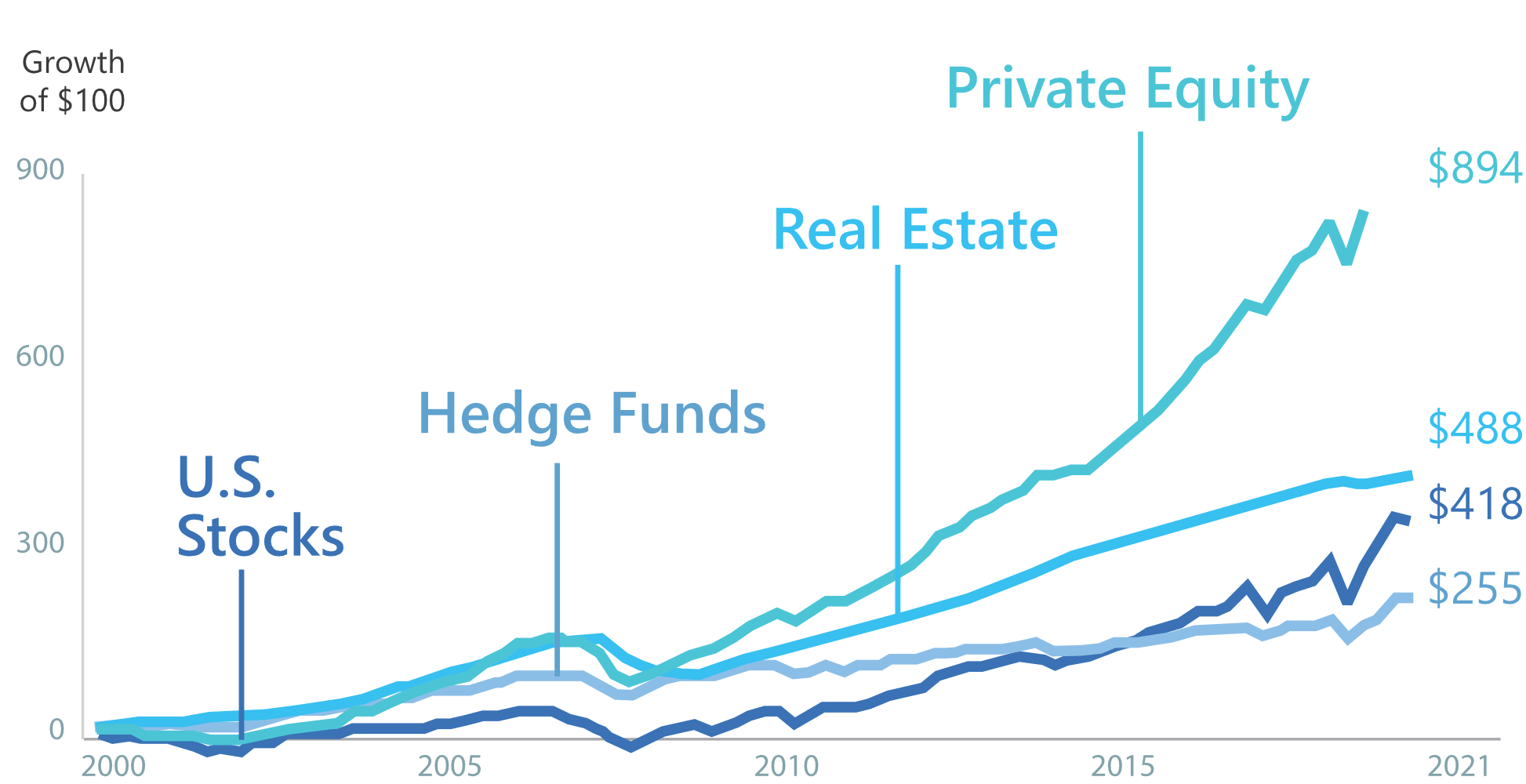

Is your portfolio missing something?

With UpMarket you can access new asset classes that are uncorrelated with the market, offer unique return profiles, and have professional management that can help you navigate market volatility and business cycles.

Our Products

Pre-IPO

Crypto

Alternative Private

Market Funds

Fixed Income

Hedge Funds

Private Equity Funds

Real Estate Funds

Pre-IPO

Crypto

Alternative Private

Market Funds

Fixed Income

Hedge Funds

Private Equity Funds

Real Estate Funds

Sophisticated Asset Classes, Simple and Transparent Management.

Due Diligence Conducted on All Offerings

Seamless Investment Process

Robust Post-Investment Monitoring