IRA vs. 401(k) – What’s the Difference?

This article explores some of the key differences between Individual Retirement Accounts (IRAs) and 401(k) plans. Please note that what plans may be best for you will depend on your unique financial situation. Before making any financial decision, we recommend you consult with someone certified to provide you with financial advice tailored to your unique circumstances.

Summary: IRA vs. 401(k) – What’s the Difference

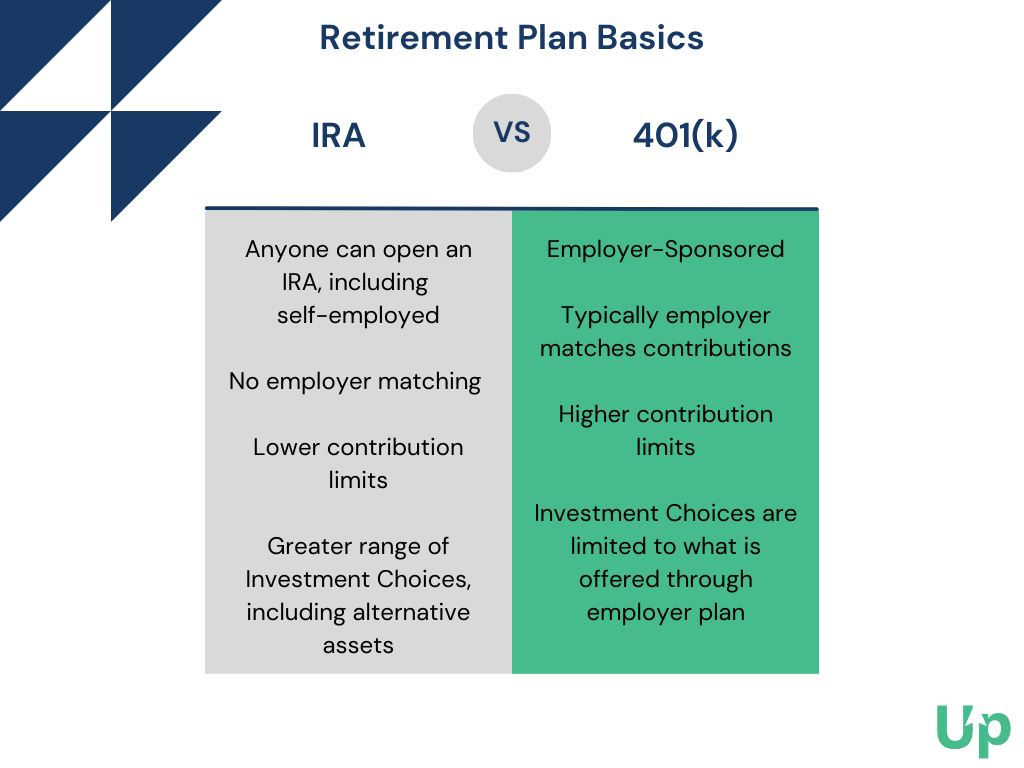

Both 401(k) and IRAs are potent retirement savings vehicles, offering various tax advantages. The choice between the two depends on individual financial circumstances and retirement goals. Generally, IRAs provide you with more investment choices but have lower contribution limits than employee-sponsored 401(k) plans.

- A 401(k) is an employer-sponsored plan with higher contribution limits and the potential for employer matching, but it usually has more limited investment options.

- An IRA is available to anyone irrespective of employment status and offers a broader range of investment choices but has lower contribution limits.

- Depending on your financial circumstances, one may offer more tax benefits than the other.

- For 2023, the 401(k) contribution limit increased to $22,500 and the IRA limit rose to $6,500

An In-Depth Look at 401(k) Plans

A 401(k) is a defined contribution plan where you, and potentially your employer, contribute to your retirement savings. Here are some key aspects of a 401(k):

- Employer Match: Many employers offer a match on your contributions, which is essentially free money contributing to your retirement savings.

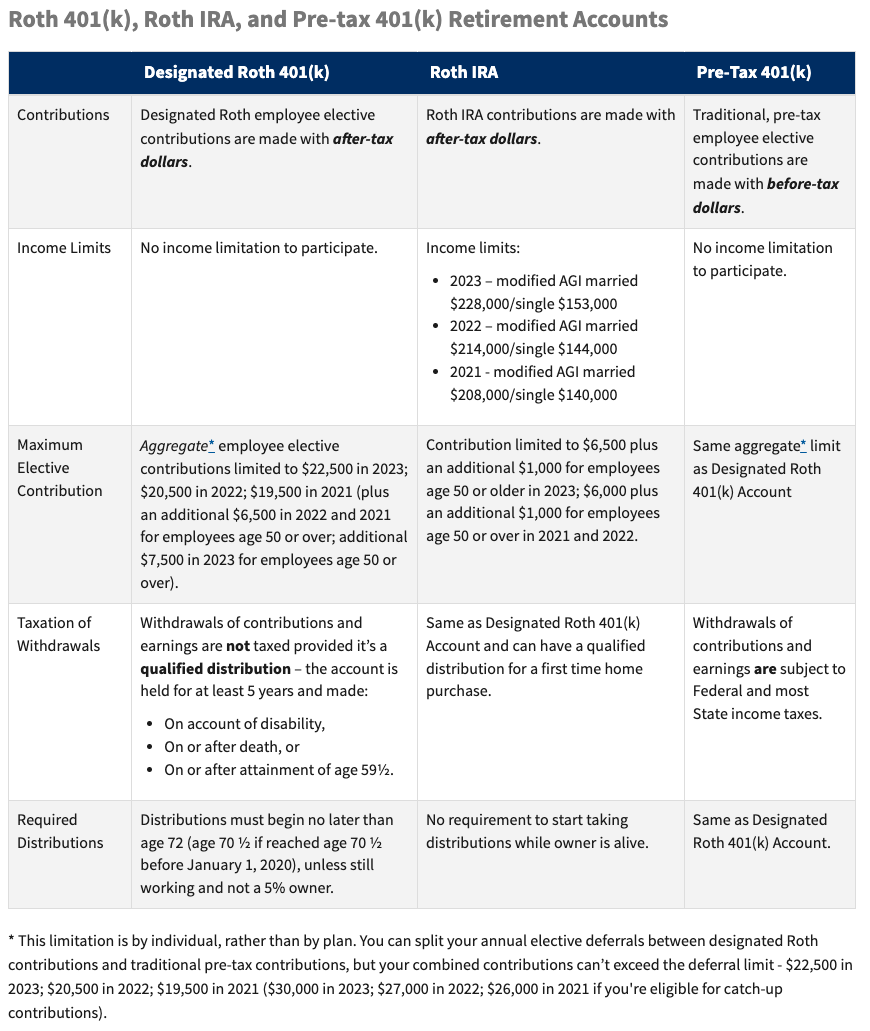

- Pre-Tax Contributions: The funds you put into your 401(k) are typically contributed pre-tax, reducing your taxable income for the year. However, you will be taxed when you start withdrawing these funds during retirement.

- Higher Contribution Limits: For 2023, the contribution limit is $22,500, allowing you to put away a substantial amount for your retirement years.

One limitation of 401(k)s is that you're typically restricted to the investment options chosen by your employer's plan provider and there may be tenure or vesting requirements that require you to stay with your employer to receive the full benefits of the plan.

An In-Depth Look at IRA Plans

An IRA, or individual retirement arrangement (as the IRS refers to them), is a tax-favored retirement account that you set up independently. Here's what you need to know about IRAs:

- Accessibility: Regardless of whether your employer offers a retirement plan, you can open an IRA if you are otherwise eligible.

- Tax Advantages: Traditional IRAs offer tax-deductible contributions and tax-deferred growth. Roth IRAs offer tax-free growth and tax-free withdrawals during retirement, provided certain conditions are met.

- Wider Range of Investment Options: Unlike 401(k)s, IRAs typically offer a broader range of investment choices.

However, it's important to note that IRAs have lower contribution limits than 401(k)s, with a cap of $6,500 in 2023.

Also, income restrictions may limit the availability of Roth IRAs. For example, in 2023, if you earned over $153,000 as a single filer or over $218,000 as a joint filer, you are not eligible to contribute to a Roth. Finally, there are multiple types of IRAs, including traditional, Roth, Payroll Deduction, SEP, SIMPLE IRA, and SARSEP plans. It's important you research these plans to understand your eligibility and the maximum economic benefit of each.

IRA vs. 401(k): A Comparative Analysis

When comparing an IRA to a 401(k), consider the following factors:

- Contribution Limits: 401(k)s have higher contribution limits compared to IRAs.

- Employer Match: Only 401(k)s offer the possibility of employer matching contributions, which can significantly boost your savings.

- Greater Investment Choice: Typically, IRA accounts give you a greater universe of investment choices, whereas 401(k) plans are limited to the options your employer provides you.

- Tax Implications: Both types of accounts offer tax advantages, but they work differently. Traditional IRAs and 401(k)s provide tax deductions on contributions and tax-deferred growth, while Roth IRAs offer tax-free growth and withdrawals.

Making the Right Decision: Factors to Consider

The choice between an IRA and a 401(k) depends on your personal financial situation, retirement goals, and the specific features of your employer's 401(k) plan (if available). You'll want to consider:

- Your Current and Future Tax Situation - for example, if you expect to be in a higher tax bracket at retirement, a Roth IRA might lower your total tax burden because you are contributing after-tax dollars now but can withdraw funds tax-free later.

- The Availability of an Employer Match - every employer plan will differ, but significant matching may make 401(k) plans more desirable despite different tax treatments.

- Your Desired Investment Options - if you want to invest in alternative assets, an IRA may be the best choice for you.

Conclusion: Balancing Your Retirement Portfolio

In many cases, a balanced retirement strategy may involve contributing to both a 401(k) and an IRA. This approach allows you to leverage the unique benefits of each, maximizing employer contributions with your 401(k) and potentially enjoying greater investment flexibility with your IRA.

Frequently Asked Questions

Can I contribute to both a 401(k) and an IRA?

Yes, you can contribute to both. Doing so can help you maximize your retirement savings. Remember, though, to be mindful of the annual contribution limits for each.

Which is better, an IRA or a 401(k)?

Neither is universally "better" than the other. Your personal financial situation, retirement goals, and the specific features of your employer's 401(k) plan should all influence your decision.

Do I get more tax breaks with a 401(k) or an IRA?

Both 401(k)s and IRAs offer valuable tax advantages. Traditional 401(k)s and IRAs provide tax deductions on contributions and tax-deferred growth. Roth IRAs, on the other hand, provide no tax deduction on contributions but offer tax-free growth and withdrawals. The best choice for you depends on your current and anticipated future tax situation.

What if my employer doesn't offer a 401(k)?

If your employer doesn't offer a 401(k) or another employer-sponsored retirement plan, an IRA is an excellent place to start your retirement savings.

What happens to my 401(k) if I change jobs?

If you change jobs, you typically have several options for your 401(k): leave the money in your former employer's plan, roll it over into your new employer's plan (if one exists and it's permitted), roll it over into an IRA, or withdraw the money (though this could lead to tax consequences and penalties).

Disclaimer: The information contained in this article is not investment advice; and does not constitute a recommendation to buy or sell any securities. The information within this article is meant for informational purposes only. Any statement in this document does not mean that the firm nor its employees agrees, endorses or approves any content of the document. This article is only for knowledge sharing and does not constitute any investment advice. Anyone who makes an investment decision based on this article does so at their own risk. Any fund investment should be made through a formal confidential private placement memorandum and other fund documents. Potential investors should carefully read the risk factors in the private placement memorandum of securities issuance, and consult their own professional consultants if necessary, and receive advice on any investment, legal, tax or accounting issues. Past performance is not indicative of future performance, and the investment may potentially result in a loss of principal. The source and data of the material are considered to be reliable. However, there is no guarantee of its accuracy or completeness. The Company has no obligation to disclose or revise or modify this statement or any forward-looking statements as the circumstances change or as a result of subsequent events. Private equity funds are only suitable for specific qualified investors to subscribe. United States sales of the fund interests are exempt under Regulation D of the U.S. Securities Act of 1933, and are only applicable to potential investors who are eligible as "Qualified Investors" under Regulation D. Sales outside the United States are exempt under Regulation S of the U.S. Securities Act of 1933. Private equity funds are sold through Upmarket Securities LLC. Upmarket Securities LLC is a U.S. registered broker-dealer, and member of FINRA.

About UpMarket

UpMarket's mission is to unlock the private markets for individual investors.

We provide access to a range of asset classes and investment strategies that span private equity, hedge funds, crypto, real estate, and other alternative assets.

The problem

- A large barrier to entry due to high investment minimums

- Time-intensive because sourcing deals is a lot of work even if you’ve got a great network, and

- Costly because of investment-related diligence costs, paperwork, and legal fees

The solution

- Offering lower investment minimums

- Sourcing and conducting diligence on opportunities for investors, empowering them to pick and choose from pre-screened opportunities

- Making the investment process entirely digital, straightforward, and easy to manage from a single portal